We have the highest inflation rate since 1981. With the U.S. inflation rate ending at 7% in 2021 and a predicted inflation rate of 8.3% for 2022, the cost of living is rising and will sure be for the years to come. To be fair, prices rise over the years (ie. today a loaf of bread costs between $1-$5 whereas 50 years ago, it would only cost about $0.25). Overall, inflation is the sign that an economy is expanding.

Then why is media presenting inflation as alarming? In this article, we’ll define inflation, explore its causes and see what makes is a good or a bad deed for the economy.

Definition

As provided by the Oxford Dictionary, inflation, in economics, is “a general increase in prices and fall in the purchasing value of money”.

Generally, talking about inflation means talking about the rise in prices, without the rise in wages. If both prices and wages increased, this would also be economically considered as inflation; however, the difference wouldn’t be felt as much.

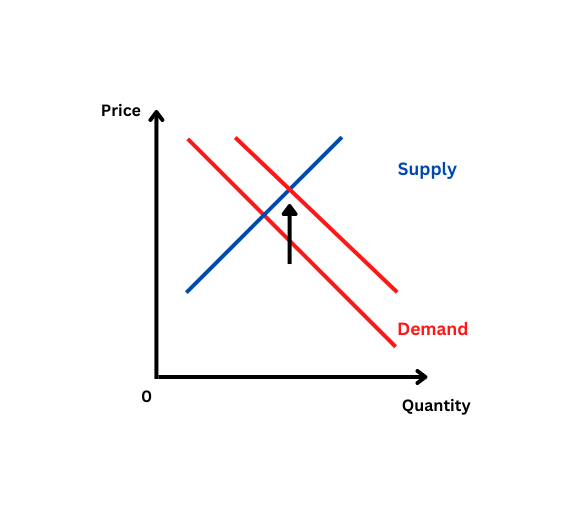

As you can see from the graphic below, the higher the supply the higher the price, whereas the higher the demand the lower the price.

Supply generally represents companies, and goods for sale (food, services, housing…). Demand, on the other hand, represents customers, and purchasing power (wages, disposable income…).

If supply prices (meaning the prices of goods for sale) increase, less customers will be able to purchase the supplies.

However, if demand prices (meaning wage and disposable income) also increase, then the same number of customers will be able to purchase the supplies.

Inflation can happen for a few sectors/products only or have severe consequences on the whole economy. The more importance the impacted resource has for society, the greater the impact of its inflation. For example, an increase in paper prices may have some impact on the book and other related industries, but will have less impact on society than an increase in oil or electricity prices.

Now that we understand what is inflation and its possible consequences, let’ see what causes it.

What causes inflation?

There are multiple causes for inflation. Here are the three types of inflation.

Cost-push

As its name indicates, cost-push inflation is inflation caused by the rise in supply prices. Ultimately, this type of inflation will also cause a rise in customer spendings, regardless of the customer’s purchasing power. In the most extreme cases, cost-push inflation can cause famine, and severe economic crises. Cost-push inflation can happen for several reasons.

First, when raw material prices increase (ie. the price of oil or wood). For instance, let’s say the copper used to create smartphones suddenly doubles or triples. Phone production companies who calculate their profits depending on the cost of materials, will have to increase their prices to keep their business going. This will in turn impact the Phone selling companies who buy these smartphones from the Phone production companies. And them too, to continue making their business viable will have to sell the smartphones at a higher price to the end customer.

Second, when salaries increase (ie. employees demand more money through strike or other political endeavors, or employee resource for a particular task is becoming scarce). For instance, let’s imagine the conditions to be a gardener are becoming more and more dangerous. Professional insurance doesn’t cover most common injuries, or when it does, it becomes really too expensive. The gardener job starts to lose in popularity among the younger populations. Furthermore, employers don’t undertake anything to ensure their gardeners’ safety.

After the death of the hundredth gardener, a strike emerges and gardener companies cease their activity. The country starts to become invaded by vegetation as more and more gardeners are going on strike. Eventually, the government establishes a policy to raise gardeners’ salary and cover the expensive insurance. Gardener companies now must pay more to generate their gardening service. Therefore, their prices increase. This would be a second example of cost-push inflation.

Third, when land rents increase (ie. not enough factories have been built or prices among a certain area increase). This one is self-evident. If the pricing of rents increases, the company’s expenses will also increase, causing cost-push inflation.

Real Life Example

A real-life example of cost-push inflation happened in October 1973 when the OPEC (Organization of the Petroleum Exporting Countries) restricted oil. This oil embargo was set to any country supporting Israel during the Yom Kippur War. It was released by March 1974. However, prices had already skyrocketed and had increased by 400%. Meaning, for the same amount of petroleum, customers would pay four times more money.

Demand-pull

Demand-pull inflation corresponds in an increase in demand for a product, while supply can’t keep up with it. Generally, demand inflation is considered to be positive inflation, as it shows consumers are well-off. As they are becoming richer, they have more money to spend and inject into the economy.

To boost the economy, governments can trigger demand inflation. They have three ways of doing so.

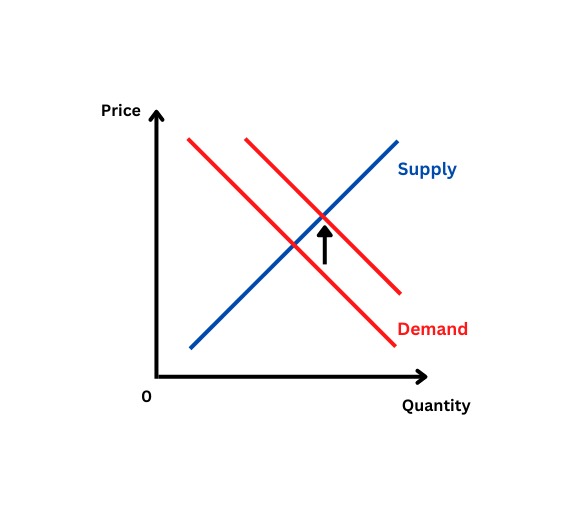

Firstly, by lowering taxes. This will increase consumers’ disposable income. However, an abuse of it can have the reverse effect by generating much higher prices. Indeed, as you can see in the graph below, if demand increases, the price will also end up increasing.

Secondly, by decreasing interest rates. As a matter of fact, if interest rates are lower, consumers will more likely borrow money. This issue here can be if these loans are used for short-time pleasures such as vacations or buying a car. By the time the market understands no further money is being generated, due to lack of worthy investments, a long-term inflation pressure is already in place (ie. prices rise due to demand inflation, and stagnate at a ridiculously high price long after the demand inflation dropped).

Last, by printing money. To stimulate the economy and create jobs, the government prints money. They can either print notes physically, increase government debt or allow bigger loans to banks. Any of these methods causes an increase in the amount of money in circulation. Similarly to previous solution, creating money can be a short-term solution. Yet, the reverse effect can be observed on the long-term as the currency loses in value and pushes prices up.

To avoid the negative long-term effects of demand-pull inflation, the positive effects must be well-seized. How so? By using the additional money to rise the country’s production through the buy of machinery and increase in employment. This rise in productivity will, in turn, increase supply and make the economy abundant.

Real Life Example

A recent real-life example we have experienced is the sub-prime crisis in 2008. The increasing demand for risky mortgages greatly increased these sub-prime’s prices. Consequently, when investors realized these investments were essentially empty shells, it was already too late and all the money invested was lost. In the meantime, other prices had increased, and this crisis resulted in a significant loss of purchasing power for a majority of customers.

Built-in

The last type of inflation is the one we mentioned in the article’s introduction. In a growing economy, inflation occurs naturally. The richer a society gets, the higher the price of the goods supplied to its customers. Meaning, over time the cost of living in a certain society increases. This is one of the reasons why we can observe such wealth disparity among different countries worldwide.

Real Life Example

The rise of prices over the years is the best real life example to provide. We can compare current prices to prices 20, 30 or 50 years ago in the same city and country for it to be self-evident. Another alternative to compare prices is to discuss with the elderly, they’ll sure tell you about “the good old days” 😉.

How to stop inflation?

As previously demonstrated, inflation should not be stopped but managed. Inflation in inherent to the growth of an economy. What matters is whether it can remain manageable and avoid sudden and uncontrollable fluctuation.

As we saw, built-in inflation occurs naturally and an increase in prices won’t matter if wages increase equally or more. The issue with inflation is that not all prices inflate at the same time. Indeed, good prices, income, housing, etc. all vary at different paces depending on the economy, current events and government decisions. This is what makes inflation so worrisome and causes media and individuals to be so alarming about it.

The more scared individuals are, the less they are willing to invest. This shortage in short-term spendings can further harm the economy and cause longer period troubles. Yet, any governmental or impactful decision made in that regards to restore the situation can end up backfiring, and worsening the overall matter.

The best setting would be a low yet steady inflation rate, as low inflation is good for savings. Indeed, the lower the inflation, the more predictable the future, the easier it is to save money since one approximately knows what their current amount of money will buy them in the future.

However, low inflation is very hard to maintain since it is difficult to predict and keep a steady hand on the all productivity components such as cost of materials, cost of labor, machinery, fall or rise in taxes, exchange rates, general growth, globalization and government endeavors and decisions.

In the end, we might just accept the fact that inflation is an inherent part of our society’s economic system and seize the opportunity inflation can represent in some cases. Indeed, during high inflation, usually Central Banks are raising their interest rates, meaning that you can save at better terms – but we’ll discuss this solution in another post.